In fact hedge accounting is currently a leading cause of restatements and. Hedge accounting 101.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting.

. When treating the items individually such as a security and its. Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a. Hedging whether in your portfolio your business or anywhere else is about decreasing or transferring risk.

What can be designated as hedging instruments. Under FAS 133 to. 12 The main changes in the IFRS 9 hedge accounting requirements Hedge accounting under IAS 39 Financial.

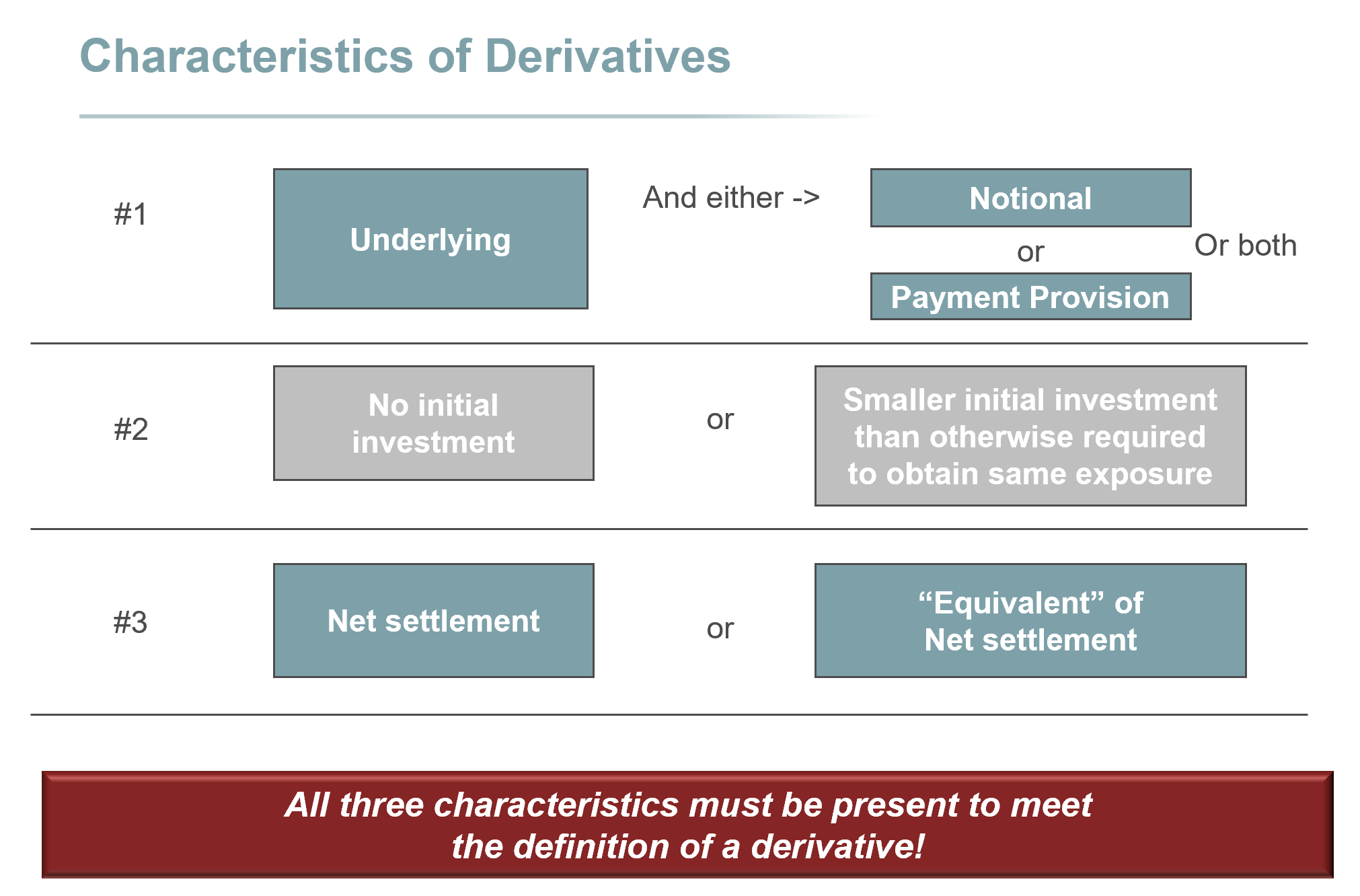

Derivative financial instruments 15 42. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the. Its pretty straight forward and very easy to understand.

Non-derivative financial instruments measured at fair value through PL 15 43. In hedging activities in both financial and non-financial services entities. IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met.

The Financial Accounting Standards Boards FASBs guidance on reporting hedging transactions is complicated. Hedge accounting is an alternative to more traditional accounting methods for recording gains and losses. Under IFRS 9 risk components of financial items such as the SONIA rate replacement of LIBOR rate in a loan that bears interest at a floating rate of SONIA plus a.

The main purpose of a cash flow hedge is to link a hedging instrument and a hedged item in situations where you expect changes in cash flows to offset one another. If a hedge is designated as a Cash Flow hedge the maturity of the derivative can be set to the expected collection date of the resulting accounts receivable. A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm.

Hedge is formed in order to lessen or eliminate economic exposure. The aim of hedging is to mitigate the impact of non-controllable risks on the performance of an entity. In the 1990s the Financial Accounting Standards Board moved to increase transparency in corporate financials by requiring derivatives to be measured.

Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been. Common risks are foreign exchange risk interest rate risk equity price risk commodity. Hedging is a valid strategy that can help protect.

Of each hedge an organization is required to demonstrate that the hedge is expected to be highly effective throughout the designated term in achieving offsetting changes in the fair value or. A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized. As the foreign revenuecost is.

It concerned with borrowing in the foreign currency to match the cash flow patterns.

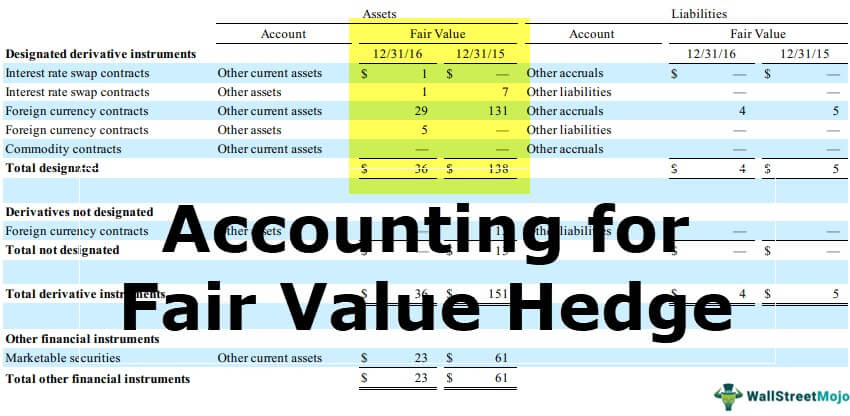

Accounting For Fair Value Of Hedges Examples Journal Entries

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Derivatives And Hedging Gaap Dynamics

Derivatives And Hedging Gaap Dynamics

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

0 comments

Post a Comment